New Tax Bill Questions

Tax reform discussions continue in Washington with legislation expected to be released very soon.

Business Entertainment Expenses

As a business owner, you are eligible to deduct certain expenses related to entertaining clients.

Can You Itemize Your Miscellaneous Deductions?

If you usually claim the standard deduction, it might be time for you to start thinking about itemizing to lower your taxes.

Virtual Currency (Cryptocurrency)

As the times start to change and more Millennials are getting jobs, virtual currency is becoming more popular.

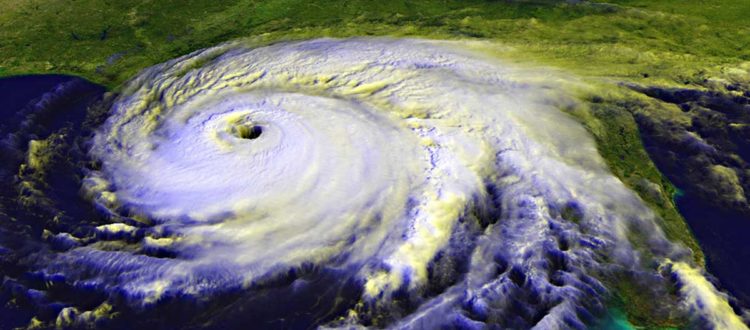

Deductions for Hurricane Loss

Tax Tips for Those Affected By Natural Disasters

10 Key Facts About Home Sales

Did you know that if you sell your home, you may not have to pay taxes?

Is It Time To Change From an S-Corp to a C-Corp?

How the Environment May Soon Change For C-Corps.

The Ins and Outs of Education IRAs

Don't miss the education-saving device that often flies under the radar; it's especially beneficial if enrolling your kids in private school.

10 Tax Tips to Close Out 2016

Now that we're in the closing weeks of 2016, it's time to finalize year-end tax saving strategies.

4 Tax Tips for Small Business Owners

If you own a small business, taxes become a bit more complicated, but there are several ways to make sure tax time is less stressful.